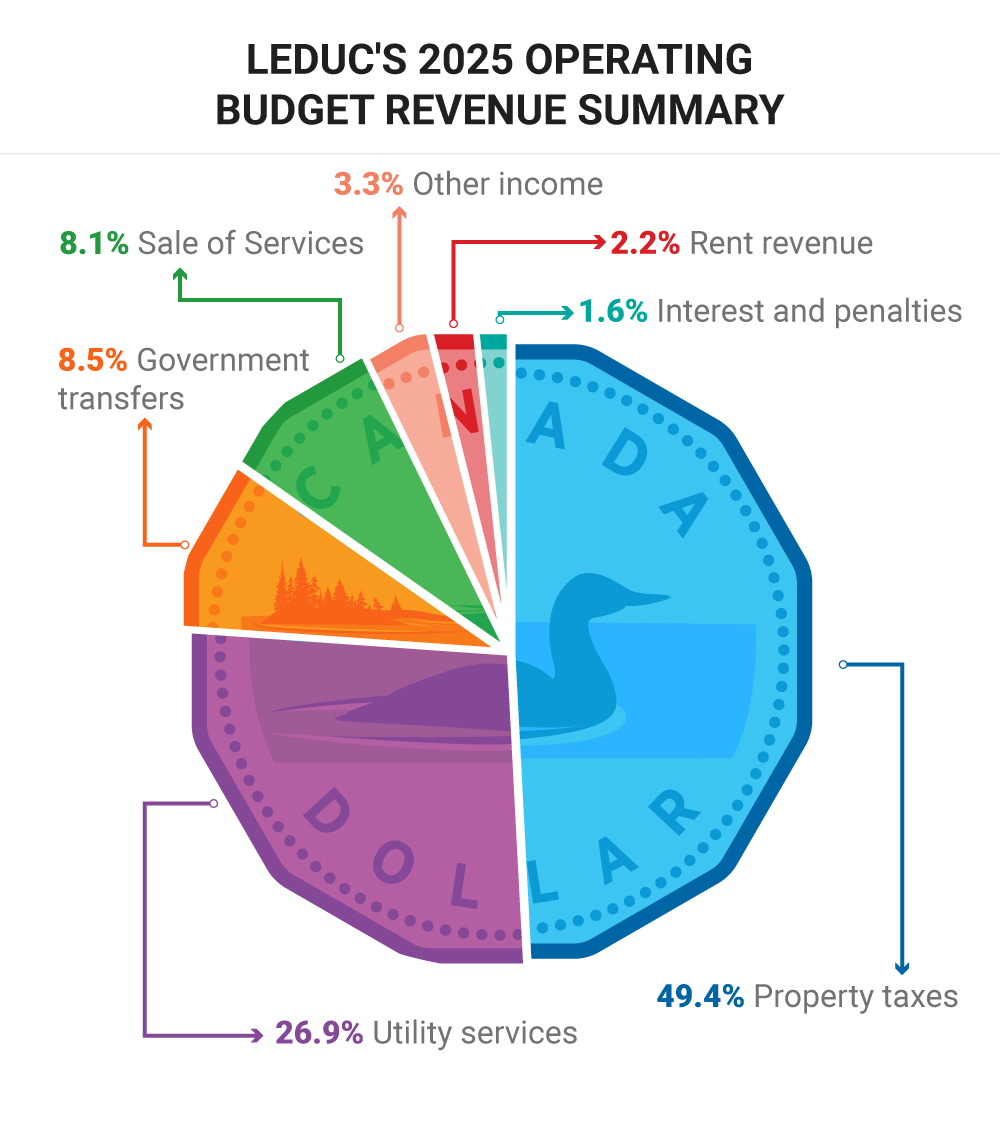

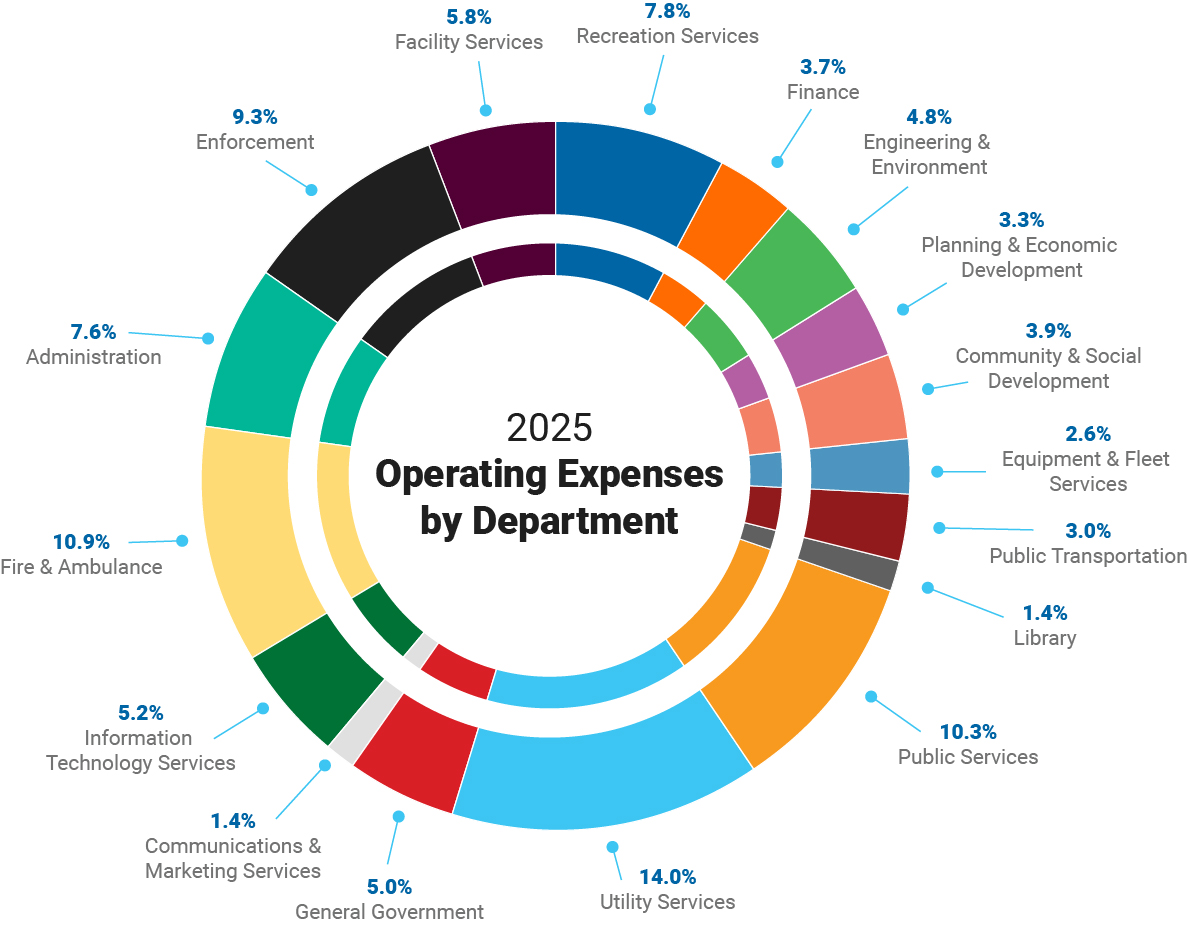

The 2025 Operating Budget and 2025-2026 Capital Budget prioritize responsible financial management while continuing to deliver the services residents rely on. The budget reflects a balanced approach to meeting community needs and managing expenses, emphasizing sustainability for the future.

Savings were achieved by reducing spending on materials and supplies (down 4% from 2024), and training and development (down 3% from 2024). These efforts helped offset increased costs, supporting the City’s commitment to service excellence.

The budget forecasts a 3.5% tax increase over 2024. Of that, 1.4% can be attributed to general economic inflationary pressures, 2% to the decrease in provincial funding for infrastructure-related expenditures, and 0.1% to a transit-related service enhancement. The final average tax increase will not be known until the spring after property assessments are complete.