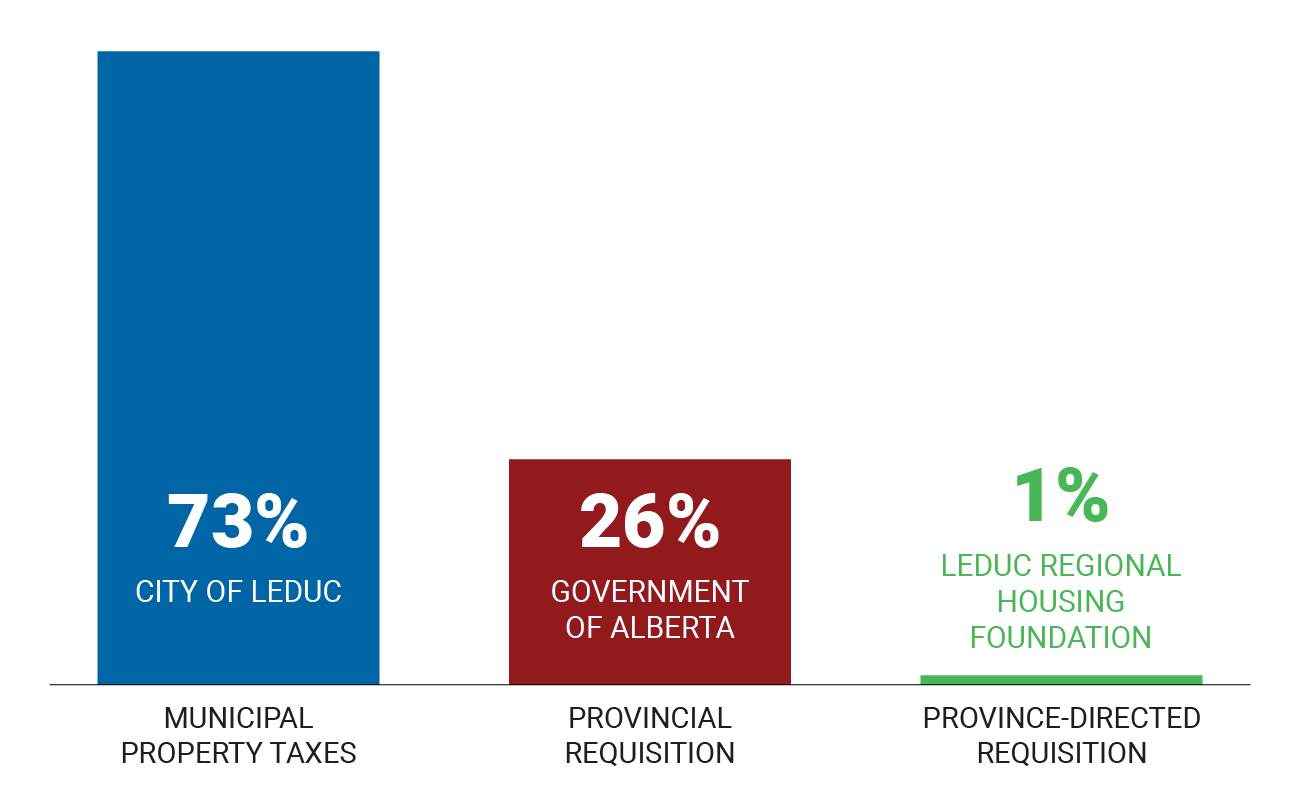

Each year Council approves the expenditures required to support City services. These services are funded through a variety of sources, one of which is property taxes.

The Tax Rate is calculated using two factors:

- The dollar amount (revenue) required to balance the budget (cover expenditures not funded through other sources)

- The City of Leduc’s total market value assessment (the value of all property in the municipal boundary)

The rate (revenue divided by assessment value) when applied to individual property value, fairly distributes the costs of service among all City of Leduc property owners.